Yardi Voyager Pricing 2024: Compare Plans and Costs

Keep reading for a highlight of the informative resource (featuring insights from our director of health care solutions and VBC expert, Fil Southerland). Voyager automates workflows and provides system-wide transparency that enables you to work more productively and collaboratively than ever before. Using any browser and mobile device, Voyager gives you instant access to your data. And as a SaaS platform, Voyager frees you from managing your software — so you can focus on your business.

Expand your marketing reach and deliver outstanding prospect and resident services with RentCafe Suite — the only completely mobile solution supporting the entire prospect and resident lifecycle, from a desktop or out what is a suspense account examples and how to use in the community. While such compensation may influence the specific products we review and where they appear on the website, it does not in any way affect BiggerPockets’ recommendations. We do not allow our advertisers to influence our opinion of such advertisers or their offers that appear on the website, and any opinions expressed are our own.

The Yardi Senior Living Suite replaces piecemeal systems with a mobile, browser-based platform for CRM, assisted living community operations, finance, health care, medication records, staff training, business analytics, and more. Take a look at Yardi Voyager Senior Housing, Yardi EHR, and Yardi eMAR each optimized for handheld and desktop devices. Similar to Yardi, AppFolio offers online rent payments, tenant screening, and business performance insights.

Yardi – Combining Property Management Functions

- Reviews should not be relied upon as the sole basis for choosing a financial product.

- Expand your marketing reach and deliver outstanding prospect and resident services with RentCafe Suite — the only completely mobile solution supporting the entire prospect and resident lifecycle, from a desktop or out in the community.

- Breeze is a refreshingly simple property management system that works for residential, commercial, affordable housing, manufactured housing, self storage and associations.

- It seamlessly manages tasks such as maintenance, move-ins, renewals, and move-outs, making it an indispensable backbone for daily operations.

- We also offer customizable solutions like mobile apps and websites for your properties.

- You can get started using Breeze in just a day, no advanced training or experience required.

The majority of users praised its automated workflow capabilities, robust and customizable performance analytics, and accounting tools. However, some cited its steep learning curve and confusing navigation as downfalls. A detailed review of Yardi’s property management software with pricing, comparisons to competitors, key hotel accounting information, and FAQs.

Breeze is a refreshingly simple property management system that works for residential, commercial, affordable housing, manufactured housing, self storage and associations. You can get started using Breeze in just a day, no advanced training or experience required. Voyager is a comprehensive system for real estate operators with unique and dynamic requirements. Yardi Multifamily Suite is built into the Yardi Voyager Residential platform to provide a full business solution, from your front office to your back office, for end-to-end efficiencies — with complete mobility. You benefit from paperless processing, cost savings, and holistic portfolio insight. Many users were satisfied with its ease of use and comprehensive accounting services.

Multiple platforms to meet your property management software needs

On average, small to medium-sized businesses can expect implementation costs ranging from $1,000 to $5,000. Larger enterprises may face higher implementation costs, typically ranging from $10,000 to $50,000. Customization costs for the software are additional and can vary based on the specific requirements of the business. Training costs are also an important consideration, with prices starting from $500 for basic training for smaller businesses and going up to $5,000 for more extensive training programs for larger legal dictionary enterprises.

Pricing:

Real estate management software is technology that makes asset and property management easier. It helps landlords, investors, leasing agents, maintenance technicians and other real estate professionals track and execute projects and data more efficiently. It also makes renting easier for tenants because it allows them to make payments, sign leases, request support and otherwise manage their accounts online. Our real estate management software includes integrated solutions for accounting, marketing and lease execution, market intelligence, energy management, end-to-end procurement, business intelligence and much more. We have multiple options for all portfolio types and sizes, from large multinational enterprises to small and midsize holdings.

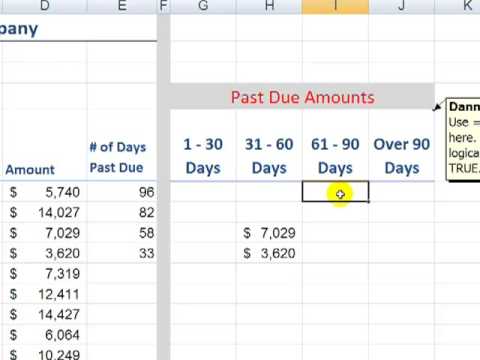

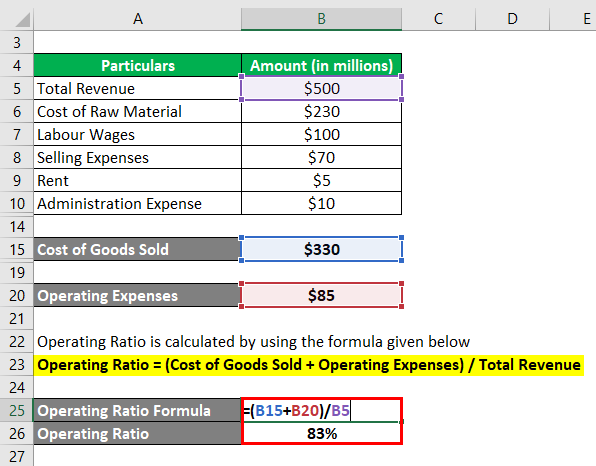

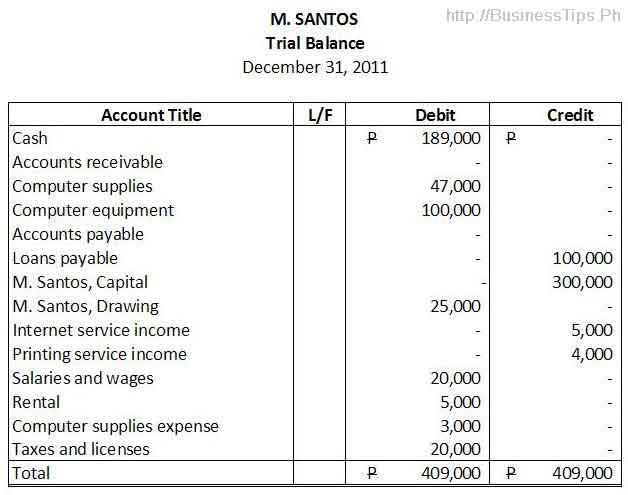

The software’s ability to maintain lease documents, prospect information, work orders, purchase orders, amenities, and rentable items ensures that all aspects of property management are efficiently handled in one centralized platform. Furthermore, Yardi Voyager proves its worth by facilitating back-end accounting processes, processing invoices, controlling expenses, and tracking property-related revenue and expenses. Buildium, on the other hand, offers pricing starting at $50 per month for up to 20 units.

Day-to-day operations are intimately tied to asset value and investment performance. Our solutions help attract and retain occupants with advanced marketing and online services, for example. Electronic billing significantly cuts the cost of collecting and processing rents. Our award-winning energy management systems reduce HVAC costs and ensure regulatory compliance without reducing comfort.