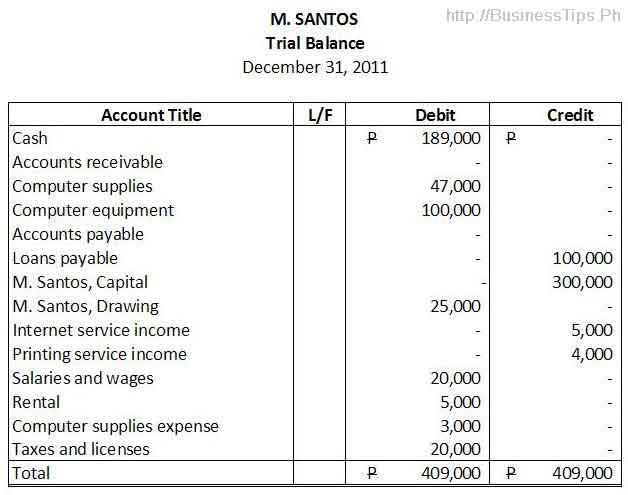

4 4: Use the Ledger Balances to Prepare an Adjusted Trial Balance Business LibreTexts

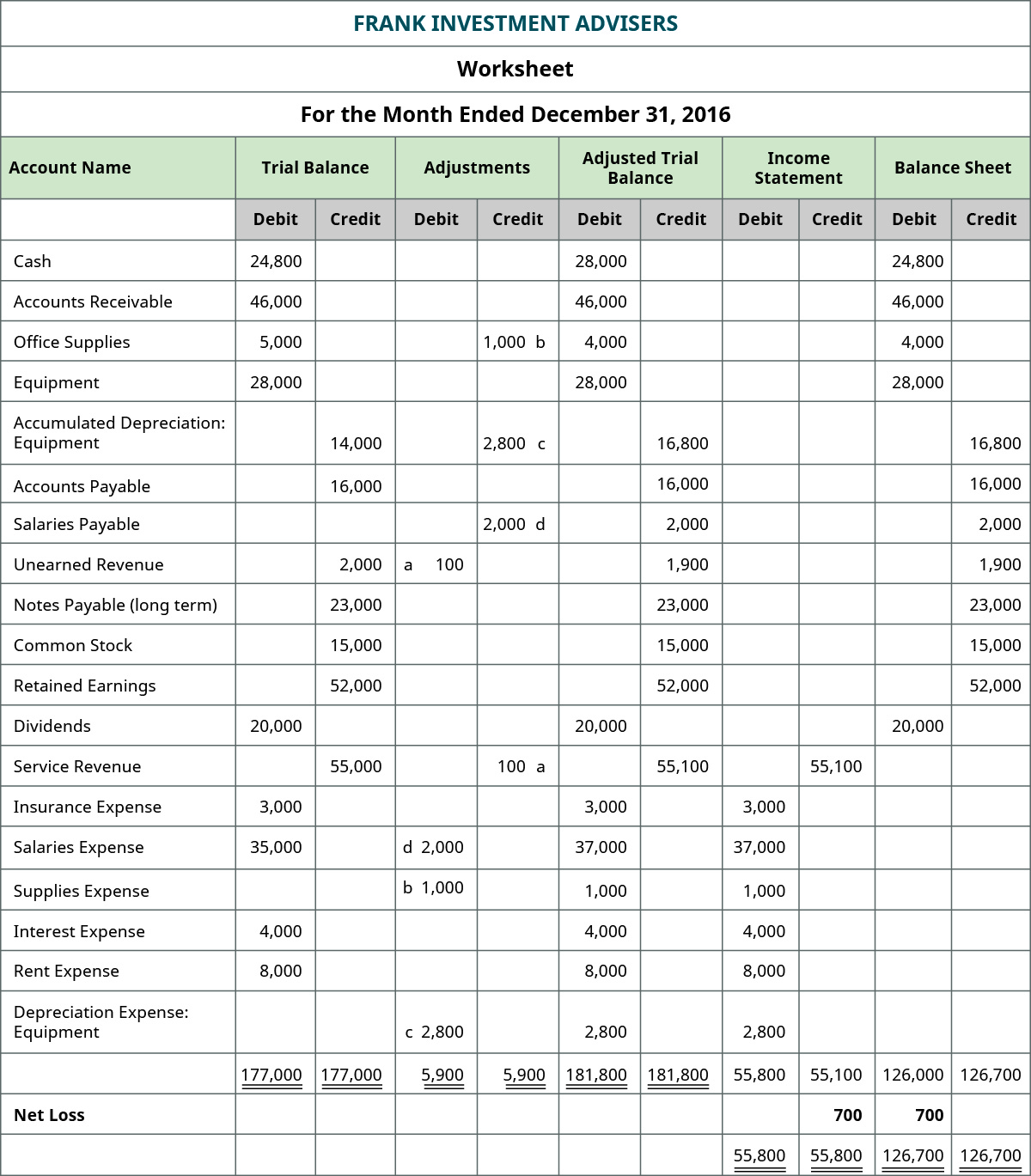

Remember that adding debits and credits is like adding positive and negative numbers. This means the $600 debit is subtracted from the $4,000 credit to get a credit balance of $3,400 that is translated to the adjusted trial balance column. The 10-column worksheet is an all-in-one spreadsheet 12 cash flow management strategies for small business showing the transition of account information from the trial balance through the financial statements. Accountants use the 10-column worksheet to help calculate end-of-period adjustments. Using a 10-column worksheet is an optional step companies may use in their accounting process.

A quick primer on double-entry accounting

The salon had previouslyused cash basis accounting to prepare its financial records but nowconsiders switching to an accrual basis method. You have beentasked with determining if this transition is appropriate. A trial balance sheet, which in itself, is a complete summary of an organization’s transaction gives a clearer picture of it when adjusted to such expenses. The salon had previously used cash basis accounting to prepare its financial records but now considers switching to an accrual basis method. You have been tasked with determining if this transition is appropriate.

Adjusted Trial Balance to Income Statement

This meansrevenues exceed expenses, thus giving the company a net income. Ifthe debit column were larger, this would mean the expenses werelarger than revenues, leading to a net loss. You want to calculatethe net income and enter it onto the worksheet. The $4,665 netincome is found by taking the credit of $10,240 and subtracting thedebit of $5,575. When entering net income, it should be written inthe column with the lower total.

Cash or Accrual Basis Accounting?

- Beginning retained earnings carry over from theprevious period’s ending retained earnings balance.

- The accounts of a Balance Sheet using IFRS mightappear as shown here.

- The total overreported income wasapproximately $200–$250 million.

You will not see a similarity between the 10-column worksheet and the balance sheet, because the 10-column worksheet is categorizing all accounts by the type of balance they have, debit or credit. If the debit and credit columns equal each other, it means the expenses equal the revenues. This would happen if a company broke even, meaning the company did not make or lose any money. If there is a difference between the two numbers, that difference is the amount of net income, or net loss, the company has earned. To get the numbers in these columns, you take the number in the trial balance column and add or subtract any number found in the adjustment column. There is no adjustment in the adjustment columns, so the Cash balance from the unadjusted balance column is transferred over to the adjusted trial balance columns at $24,800.

Trial Balance vs. Balance Sheet

It is important to go through each step very carefully and recheck your work often to avoid mistakes early on in the process. Another way to find an error is to take the difference between the two totals and divide by nine. If the outcome of the difference is a whole number, then you may have transposed a figure. For example, let’s assume the following is the trial balance for Printing Plus. One way to find the error is to take the difference between the two totals and divide the difference by two.

You then add together the $5,575 and $4,665 to get a total of $10,240. If you review the income statement, you see that net income is in fact $4,665. Next you will take all of the figures in the adjusted trial balance columns and carry them over to either the income statement columns or the balance sheet columns. The statement of retained earnings always leads with beginning retained earnings. Beginning retained earnings carry over from the previous period’s ending retained earnings balance. Since this is the first month of business for Printing Plus, there is no beginning retained earnings balance.

This trial balance type allows businesses have a summarized view of all the account balances post-adjustment to respective expenditures. Companies can use a trial balance to keep track of their financial position, and so they may prepare several different types of trial balance throughout the financial year. A trial balance may contain all the major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses.

Once all the necessary adjustments are absorbed a new second trial balance is prepared to ensure that it is still balanced. All ledger balances and their respective debit and credit balances are listed within this and are further used to prepare the financial statements of a company. A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. The debits and credits include all business transactions for a company over a certain period, including the sum of such accounts as assets, expenses, liabilities, and revenues. In our detailed accounting cycle, we just finished step 5 preparing adjusting journal entries. We will use the same method of posting (ledger card or T-accounts) we used for step 3 as we are just updating the balances.

However, this does not mean that there are no errors in a company’s accounting system. For example, transactions classified improperly or those simply missing from the system still could be material accounting errors that would not be detected by the trial balance procedure. This is the second trial balance prepared in the accounting cycle.